We are hearing a lot of rumbling about refinances being gone and the only new loans being done will ...

Blog & News

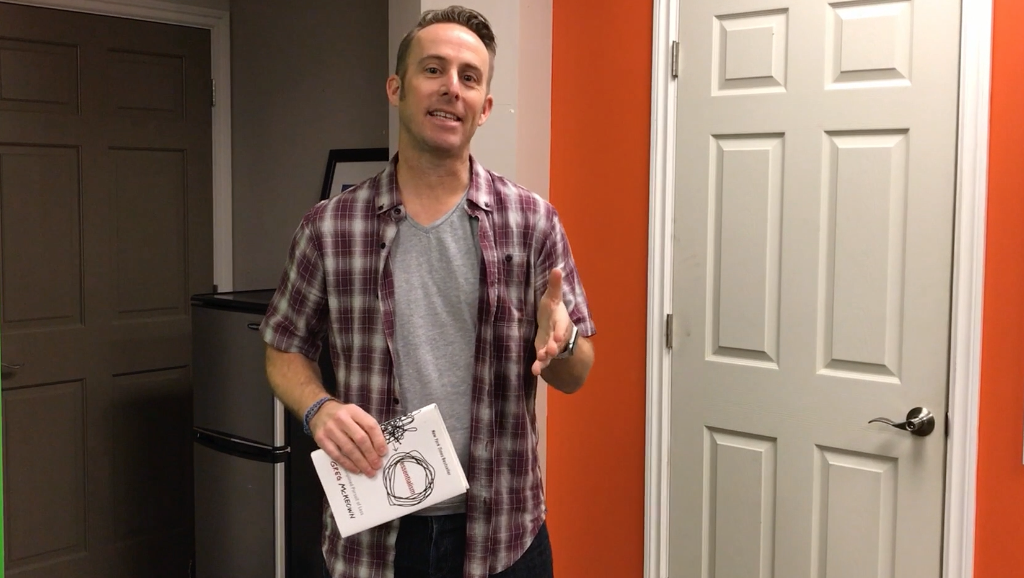

Ken has the uncanny ability to make friends with just about anyone, doesn't matter who they are or w...

HUD is removing some programs that we think are REALLY good! In fact we teach about them in the 8 Ho...

Let's just dive into this...

Ken is on the road teaching the 8 Hour SAFE Comprehensive Live Continuing Education. Only a few clas...

14 years today! That's how long Ken has been training professionals in the mortgage industry. And th...

How do you prepare to hire people for your team? How does your team handle ideas and dreams? Do you ...

Our fearless CEO, Anthony Miller, whom you saw driving last week, is attending the Independent Mortg...

Ken and Anthony are returning from 2 days away where they took time to do the Annual Plan. Ken has s...

In his best selling breakout Good to Great, Jim Collins wrote about busses, seats, and people in tho...

-1.png?width=200&height=59&name=kc_logo_white_no_lgw@2x%20(1)-1.png)

.png)