Blog & News

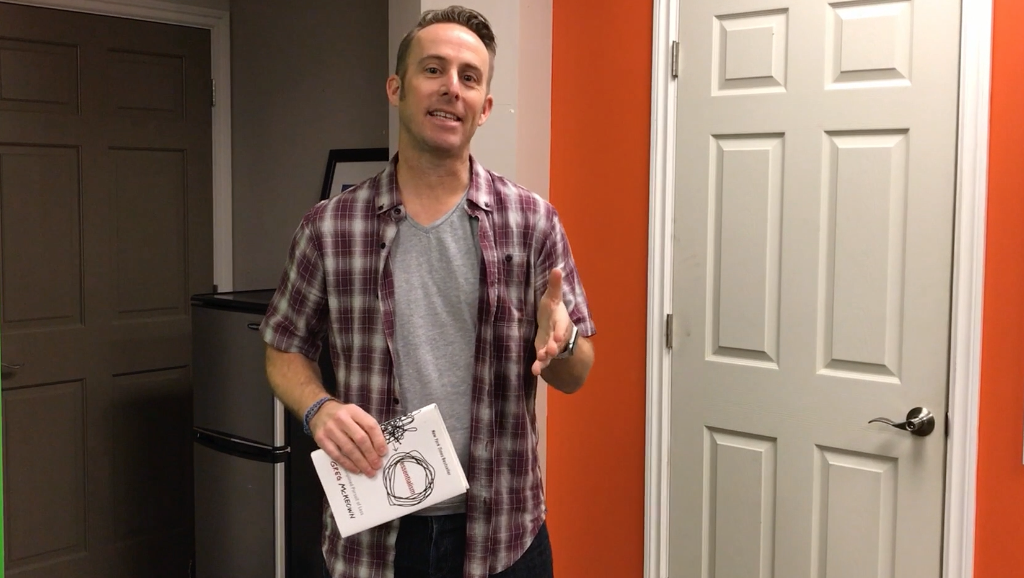

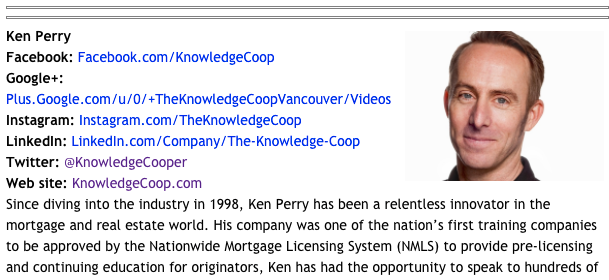

A Message from CEO and President Ken Perry

The mortgage industry is on the brink of a major game-changer as AI technologies, like machine learn...

If you don’t already know Jerry Baker, CEO Mentor at Building Champions, you have been missing out! ...

The mortgage industry is on the cusp of transformation, with AI at the forefront of this evolution. ...

With the recent passage of HR 7735, better known as *Improving Access to the VA Home Loan Benefit Ac...

You might remember the United Wholesale Mortgage lawsuit we talked about almost a year ago. Link her...

Hi all! I’ve been reflecting on the past couple of months and wanted to tell you a little bit of a s...

Mortgage applications follow a pretty set process. Lenders check whether income and assets meet cert...

There is a lot of buzz in the industry right now about Mortgage Insurance, specifically whether or n...

The LO Comp Rule is one of those topics that comes up a lot in the mortgage industry, and unfortunat...

Sometimes your company policies make a lot of sense, and sometimes they don't. Hopefully though your...

We've all been there. You say "Pre-Qualified", and the borrower hears "Qualified". Sometimes borrowe...

A thing of value under $25 is safe, right? Nope. Common misconception that has spread around the ind...

We had a great interview with Jason Manning (Partner) and Mandi Blackmon of Troutman Sanders, LLP. T...

We had a great interview with Bob Niemi of Bradley, LLP. He presented a lot of solid information abo...

This week, we bring you the LO down on the sudden return of the NINA loan.

This week the DoD fires back agains the CFPB, FHFA plans on launching a language resource, and the C...

Apparently strict overwatch doesn't affect actual production, just product mix.

Ken and Sawyer cover what the industry is trying to do with the LO Comp rule, and some other stuff t...

Falsified Records, Reverse Mortgages, and new Home Sales in this week's roundup!

More CFPB unrest from Capitol Hill, be wary in the wake of disaster, and could Fannie Mae and Freddi...

Destroyed Dreams, CFPB Reports, and Leadership Changes: Tune in for This Week's Roundup!

Appraising Appraisers, Staying Strong and Criterion Clarification This Week in the Roundup!

Borrower preferences, GSE roles, and CFPB vacancies -- All in this week's Roundup!

Sawyer breaks down the IRS's changes to tax transcripts, home-purchasing sentiment plateauing, and t...

A one-dollar civil penalty, love affairs at Fannie Mae, and a heads-up to service members || All in ...

The CFPB's advisor, wildfire response, and a new Encompass release are all tackled this week by Sawy...

Fannie & Freddy "crossing the line", TRID 2.0, and the CFPB's enforcement actions are covered th...

Kathleen Kraninger’s stance on Equifax, changes to the leadership of Fannie Mae, and the amount of n...

This week, Sawyer covers the FHFA's unconstitutionality, the CFPB's new task force on Market Integri...

This time around, Sawyer covers the Leandra English debacle, US job growth, and the green expectatio...

This week, Sawyer discusses the why Millennials slowed down buying houses, what's the big deal about...

This week, Sawyer discusses the update to Zillow’s CFPB enforcement, Trump’s detail-sparse plan, and...

In this week's Round Up, Sawyer talks HMDA reporting and Mulvaney's rendition of "Should I Stay Or S...

In this week's Round Up: The CFPB’s new target, the impact of the Fed’s hiked rates, and your right ...

In this week's update: Nathan discusses how not strengthening your strengths can be a weakness and h...

Sawyer Talks about changes to the CFPB (BCFP) Advisory Council, Fannie and Freddie conservatorship, ...

Sawyer Talks About a Potential HMDA Rollback, CFPB studies, and Workers in the Gig-Economy. Watch Be...

Ken talks about his experience with two different hotels and what it means for technology and busine...

What happened to Dodd-Frank? Sawyer takes a look at the changes made by the Trump Administration, "B...

Ken weighs in on the Laurel vs. Yanny debate, and how video can be a powerful tool for your business...

Is it true? Does Ken's hair really draw a crowd? Find out the answer to that burning question and a ...

Ken was on Facebook Live today, contemplating a recent trend and its effect on the industry and your...

Sawyer delivers his final industry update as a single man!

News you should know in the mortgage industry, brought to you by Sawyer!

Since 2015 the release of the TILA-RESPA rule answered a lot of questions, but also created more, an...

News in mortgage: CFPB Complaints Are Going To A Farm Upstate!

News in mortgage:

Could it really happen? Is the CFPB dropping their complaint roster? Well, maybe. According to an ar...

News in mortgage:

News in mortgage:

This week the FTC released some big news on their blog. Now you can report identit y theft on identi...

News in mortgage:

News in mortgage: On the regulatory relief bill, on non-banks in the media, on a new proposed name &...

As Ken tours Oregon with his 8-hour CE seminar, he takes a moment to share his thoughts on the CFPB,...

Don't loose track of the latest in the mortgage industry - Watch our video on last week's hottest ne...

In this Weekly Update, Nathan brings in Lord of the Rings and Greg McKeown's book, Essentialism, to ...

Here's to Mortgage Action Alliance for being extremely proactive, to the FHA for extending disaster ...

Let's get real. No one really knows how the recent tax reform will play out, at least not until it t...

Learn how the nation is standardizing online notarization, how NAMB wants to outlaw trigger leads, a...

Trump's 2019 HUD budget includes extended Fannie & Freddie guaranty fees, a fee to lenders for F...

What's the worst case scenario you can think of… be you a loan officer, a mother of three, a borrowe...

CFPB interim director, Mick Mulvaney, takes a symbolic yet concrete approach to his efforts in chang...

In 2018, you could use the Knowledge Coop's CE as a reason to travel to Hawaii or even Alaska! But, ...

Ken's advice from friend Dave Savage of Mortgage Coach suggests we make 3 words our words for 2018.

We can do anything when we're motivated and have a plan.

Every time Ken’s off to travel, he has several customer service exchanges that offer mini-case studi...

The Knowledge Coop wanted to beat the rest of the advice that'll soon be doled out for the new year ...

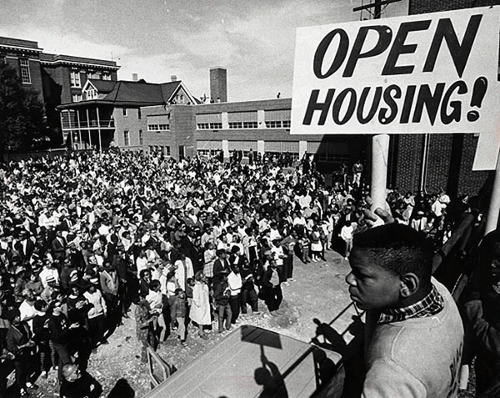

TILA TILA is the Truth In Lending Act which was passed in 1968. The act was designed to increase the...

Video connects you to people in tangeable and qualitative ways. Don't be afraid to start using it! S...

We want to disrupt the CE and training world. What do you want to disrupt and why?

We all make a choice every day that deals with Trade-Offs or Opportunity Costs. No matter what you c...

You never want to lose a loan to someone who out-read and out-researched you. So why not approach it...

Okay, maybe you did know these things about RESPA, but apparently Zillow didn't. We've created this ...

We are hearing a lot of rumbling about refinances being gone and the only new loans being done will ...

Ken has the uncanny ability to make friends with just about anyone, doesn't matter who they are or w...

HUD is removing some programs that we think are REALLY good! In fact we teach about them in the 8 Ho...

Let's just dive into this...

Ken is on the road teaching the 8 Hour SAFE Comprehensive Live Continuing Education. Only a few clas...

14 years today! That's how long Ken has been training professionals in the mortgage industry. And th...

How do you prepare to hire people for your team? How does your team handle ideas and dreams? Do you ...

Our fearless CEO, Anthony Miller, whom you saw driving last week, is attending the Independent Mortg...

Ken and Anthony are returning from 2 days away where they took time to do the Annual Plan. Ken has s...

Ken was listed as one of the top 50 Most Connected Mortgage Professionals. Rick Grant interviewed hi...

In his best selling breakout Good to Great, Jim Collins wrote about busses, seats, and people in tho...

We are a training and compliance company at heart. Everything we do is focused at making sure our cl...

As we watch closely, there are decisions being made today that may affect our industry tomorrow. How...

We've all had the customer service that was just AMAZING. We've all had the other customer service. ...

In the Northwest, we are reminded yearly about how to NOT deal with whales on beaches. November 12 m...

Our friends at the REsource.tv posted a very thought provoking video today. We've received many emai...

At the MBA Conference there are a few things we always listen for. One of them is any hint at a chan...

Ken and Anthony are returning from the 2016 MBA conference. There are three things they are taking a...

The truth about Appraisals is that they are arduous, long, and frustrating. Lots of fingers point bl...

So the CFPB lost the decision in the Court of Appeals PHH vs. CFPB... What does that mean to you, me...

On Tuesday September 20th the biggest thing in Ken's life wasn't the Mac Sierra OS update. Actually ...

Ken was live on Facebook Wednesday morning with Dave Savage from

Ken was in Vail, CO for the CMLA last week: One of the great parts about the job when not reading re...

-1.png?width=200&height=59&name=kc_logo_white_no_lgw@2x%20(1)-1.png)

.jpg)

.jpg)

.png)

.png)

.png)

.png)

.png)